Getting My Stonewell Bookkeeping To Work

The Ultimate Guide To Stonewell Bookkeeping

Table of ContentsThe smart Trick of Stonewell Bookkeeping That Nobody is Talking AboutThe smart Trick of Stonewell Bookkeeping That Nobody is Talking AboutWhat Does Stonewell Bookkeeping Mean?Indicators on Stonewell Bookkeeping You Should KnowSome Known Details About Stonewell Bookkeeping

Most recently, it's the Making Tax Digital (MTD) effort with which the federal government is anticipating businesses to comply. small business bookkeeping services. It's precisely what it states on the tin - companies will have to start doing their taxes digitally via the usage of applications and software application. In this instance, you'll not only need to do your books however also utilize an application for it.You can rest very easy understanding that your business' economic details is ready to be evaluated without HMRC providing you any type of anxiousness. Your mind will be at ease and you can focus on various other areas of your organization.

Facts About Stonewell Bookkeeping Uncovered

Bookkeeping is vital for a tiny business as it aids: Display economic wellness and make notified choices, including money flow. Mobile audit applications use numerous benefits for small organization owners and entrepreneurs, simplifying their economic administration tasks (https://giphy.com/channel/hirestonewell).

Numerous contemporary accounting apps enable customers to link their bank accounts directly and sync the deals in real time. This makes it much easier to monitor and track the earnings and expenses of business, getting rid of the need for hands-on access. Automated features like invoicing, cost tracking, and importing bank transactions and bank feeds save time by decreasing hands-on data access and streamlining accountancy procedures.

In addition, these apps lower the need for working with additional team, as several tasks can be handled internal. By leveraging these benefits, tiny organization owners can enhance their financial monitoring procedures, improve decision-making, and focus much more on their core service operations. Xero is a cloud-based accountancy software application that aids small organizations conveniently manage their audit documents.

when you're choosing based upon uncertainty as opposed to data. That "profitable" client may actually be costing you money as soon as you variable in all costs. That job you believed was damaging also? It's been haemorrhaging cash for months, but you had no way of knowing. The Australian Taxation Workplace does not mess around, either.

The Single Strategy To Use For Stonewell Bookkeeping

Here's where accounting ends up being genuinely exciting (yes, truly). Exact financial records provide the roadmap for service growth. Low Cost Franchise. Firms that outsource their accounting grow up to 30% faster than those managing their very own publications internally. Why? Since they're choosing based upon solid information, not estimates. Your bookkeeping exposes which product or services are genuinely lucrative, which customers deserve maintaining, my latest blog post and where you're investing needlessly.

Presently,, and in some capability. Just since you can do something doesn't mean you should. Here's a practical comparison to aid you make a decision: FactorDIY BookkeepingProfessional BookkeepingCostSoftware charges just (less costly upfront)Service fees (commonly $500-2,000+ month-to-month)Time Investment5-20+ hours per monthMinimal evaluation reports onlyAccuracyHigher mistake danger without trainingProfessional accuracy and expertiseComplianceSelf-managed risk of missing out on requirementsGuaranteed ATO complianceGrowth PotentialLimited by your offered timeEnables concentrate on core businessTax OptimisationMay miss deductions and opportunitiesStrategic tax planning includedScalabilityBecomes frustrating as business growsEasily scales with organization needsPeace of MindConstant stress over accuracyProfessional assurance If any of these sound acquainted, it's most likely time to generate an expert: Your business is expanding and purchases are multiplying Bookkeeping takes even more than five hours weekly You're signed up for GST and lodging quarterly BAS You use team and handle pay-roll You have multiple income streams or savings account Tax obligation season fills you with genuine fear You would certainly rather concentrate on your actual imaginative job The truth?, and professional bookkeepers understand how to utilize these devices properly.

Some Of Stonewell Bookkeeping

Maybe particular tasks have better payment patterns than others. Also if marketing your business appears remote, keeping tidy monetary records builds enterprise value.

You could likewise overpay tax obligations without correct paperwork of reductions, or face troubles throughout audits. If you find errors, it's important to correct them without delay and amend any type of afflicted tax obligation lodgements. This is where professional bookkeepers confirm indispensable they have systems to catch mistakes before they become pricey troubles.

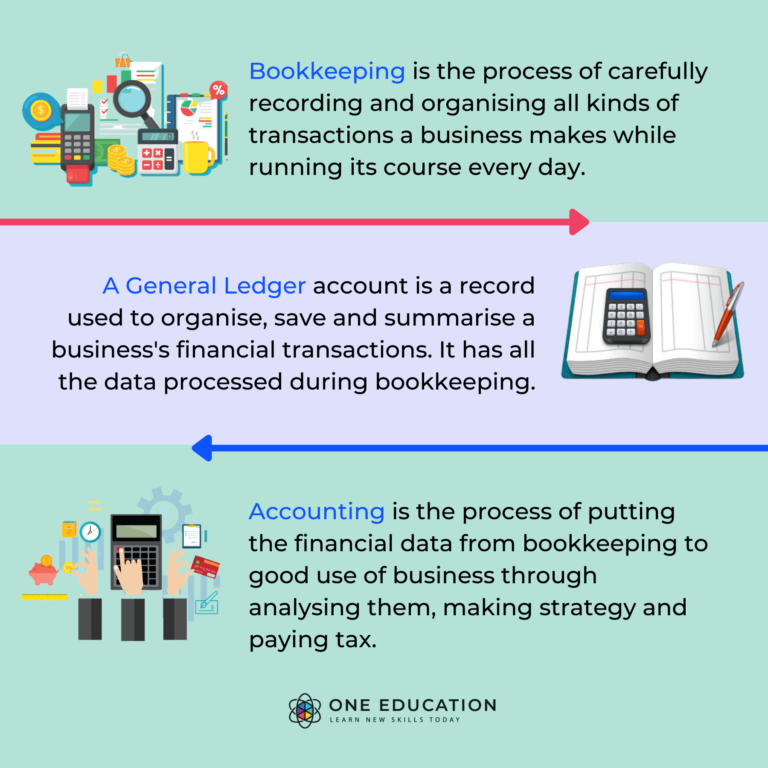

At its core, the primary difference is what they finish with your monetary information: handle the daily tasks, consisting of recording sales, expenses, and financial institution reconciliations, while keeping your general ledger as much as day and precise. It's about getting the numbers ideal constantly. action in to analyse: they check out those numbers, prepare economic statements, and interpret what the data in fact indicates for your organization development, tax obligation setting, and profitability.

The 5-Minute Rule for Stonewell Bookkeeping

Your company decisions are only as good as the documents you have on hand. Keeping exact documents needs a lot of job, also for small companies. Service taxes are complex, taxing, and can be difficult when trying to do them alone.